Win ratio was only 33% which is sub-par with past results. Still keeping positions 50% or less of average size. I'm realizing that there may be a direct correlation of when volatility is extremely high to the success of the reversion method i've been utilizing. By advocating tight stops with robust targets, i've managed roughly a 8:1 ratio reward to risk. Needless to say i would take profits well before the target but was still able to average daily target goals by +200-300%. For the last week and a half i've been taking larger losses and find myself back to square two (that's just one step above step one, lol). I am always open to constructive criticism and will continue to extrapolate the daily data from which i've traded. Here are today's results of a few for further self education purposes.

AA - 2 shorts that didn't work, 1st stop was a good loss, 2nd stop i don't agree with now.

CMI - Long off opening strength and got filled long at high and stopped out at low. JEEZ

FFIV - All looked well on short. LESSON: USE NEW HIGH STOP AND ADD +.10 AND SIZE ACCORDINGLY TO RISK

POT - Tried to short, didn't want to chase so never took it...and it became the one that got away

Wednesday, August 31, 2011

Tuesday, August 30, 2011

Still very small positions and taking fewer trades. Only hit +35% of daily goal

1st positive day in a week, still staying cautious

FCX - Long wrong, short wrong. Lesson: INDICATORS DID NOT SAY READY TO SHORT.

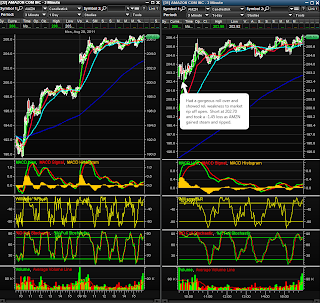

LVS - great long entry on break of yest. highs, however failed to give wiggle room and took off prematurely keeping only +.10 instead of +1.5

BIDU - initial long worked out well, but didn't look to re-enter on obvious p/b at 50 MA and previous high.

FCX - Long wrong, short wrong. Lesson: INDICATORS DID NOT SAY READY TO SHORT.

LVS - great long entry on break of yest. highs, however failed to give wiggle room and took off prematurely keeping only +.10 instead of +1.5

BIDU - initial long worked out well, but didn't look to re-enter on obvious p/b at 50 MA and previous high.

Monday, August 29, 2011

Red on day but for small loss. Still very small positions to regain psycological edge!

Decent day re-learning basics. Kept stops tight and kept loss very minimal. Really focusing on risk management and reading price action better. Caught myself during this review of not watching indicators real time and see that i need to focus on utilizing tools.

FCX - Long off gap up open looking for a runner, switched short for small gain to make up for loss

AMZN - Short off gap up fade as market looked to continue. Wrong

AAPL - short as price action looked toppy

WYNN - Great consolidation and volume spiked showed hand to get long

FCX - Long off gap up open looking for a runner, switched short for small gain to make up for loss

AMZN - Short off gap up fade as market looked to continue. Wrong

AAPL - short as price action looked toppy

WYNN - Great consolidation and volume spiked showed hand to get long

Friday, August 26, 2011

+$12, I am a Golden God!

Today is the definition of victorious. I try to always post % as it doesn't matter if your trading 1 share or 1k shares. When dealing in terms of probability, it's wisest to go by % as it's more applicable in real world applications. Anyway, today i broke my losing streak, granted i only ended the day +$12, however after getting my ass handed to me by the market, re-educating me in proper risk management i am still taking much smaller positions to gain my edge back. Without an edge, probability will slowly bleed you out over time. Here are my lessons for the day.

GS - short for a small gain after open

TNA - attempted long and got stopped out right before the rocket ship hit

ATPG - Lesson of the day

BIDU - short for +1

GS - short for a small gain after open

TNA - attempted long and got stopped out right before the rocket ship hit

ATPG - Lesson of the day

BIDU - short for +1

Thursday, August 25, 2011

Trading much smaller positions to build the confidence back. Cut losses back by 66% of past few days by utilizing smaller sizing

BIDU - Shorted a great entry but really jumpy on exit. Small gain

GS - Tried long 3 times for losses before i finally was smart enough to say "hey, this stock is weak today, look elsewhere"

GS - Tried long 3 times for losses before i finally was smart enough to say "hey, this stock is weak today, look elsewhere"

Wednesday, August 24, 2011

3rd Straight loss day of over -200% daily loss allowance. Back to Basics

I'm imposing a new rule. After 2-3 straight days of ending red, i am stepping down to 25% position sizing maximum. Here are todays ass-smacking losses. I traded with 50% accuracy today which tells me i still need to work on managing losers quicker and allow winners to run.

TNA - Great long entry on break of intraday highs but allowed bruised ego to take gains WAY TO QUICK. Only took +.25 when there was +2 potential. Read the topping pattern great, AMAZING ENTRY on the short side (trade #2) and yet again exit too early taking +.8 when there was +3 potential.

BIDU - 2 long attempts, both failed.

TNA - Great long entry on break of intraday highs but allowed bruised ego to take gains WAY TO QUICK. Only took +.25 when there was +2 potential. Read the topping pattern great, AMAZING ENTRY on the short side (trade #2) and yet again exit too early taking +.8 when there was +3 potential.

BIDU - 2 long attempts, both failed.

Tuesday, August 23, 2011

Back to 1/2 sizes, and still got smoked, less then 25% accuracy. Not a good day for reversion tactics.

Tuff week so far. In 2 days i've managed to erase 1 whole week of trading gains. Yesterday's mistake of miss managing sizing for risk was an easy learning experience however today i cut back from 2x size to 1/2x size and still had a -250% loss of daily target which leads me to beg the question "Is it my method that has stopped working or my interpretation of the method?" When i'm wrong, i'm really wrong.

POT - Anticipated breakout long so took position and got shaken out right at support instead of realizing that the pullback to 51 should have been welcomed.

NFLX - Shorted roll over and was wrong

GMCR - Shorted roll over and was wrong again....should have gotten the clue strong day that just wouldn't stop. LESSON, AFTER SEVERAL SHORTS FAIL (2 OR MORE) SWITCH TO LONGS AND GO WITH MARKET DIRECTION INSTEAD OF REVERSION METHODS

FSLR - Finally a short that worked

POT - Anticipated breakout long so took position and got shaken out right at support instead of realizing that the pullback to 51 should have been welcomed.

NFLX - Shorted roll over and was wrong

GMCR - Shorted roll over and was wrong again....should have gotten the clue strong day that just wouldn't stop. LESSON, AFTER SEVERAL SHORTS FAIL (2 OR MORE) SWITCH TO LONGS AND GO WITH MARKET DIRECTION INSTEAD OF REVERSION METHODS

FSLR - Finally a short that worked

Monday, August 22, 2011

Raised lot sizes too big and got hammered. -300% of daily loss. Didn't honor quiting the day when -100% stop target is hit.

AMZN great initial short that took off prematurely (still fighting that) and then tried a long with too much size...was right but tighter stop caused a loss.

NFLX Took initial loss, then tried again and took gains too quick trying to catch counter rallies and got spanked.

LESSON OF THE DAY: KEEP SIZE COMFORTABLE SO TRADES CAN BREATHE. RISK MANAGEMENT WITH SMALL-MID SIZE LOT SIZES ALLOWS ROOM TO MOVE SO IF WRONG, STOPPED OUT BUT IF RIGHT CAN MOVE. WHEN TAKE TOO BIG POSITIONS, STOCKS CANNOT BREATHE SO EVEN IF RIGHT ENTRY, GET HIT!

NFLX Took initial loss, then tried again and took gains too quick trying to catch counter rallies and got spanked.

LESSON OF THE DAY: KEEP SIZE COMFORTABLE SO TRADES CAN BREATHE. RISK MANAGEMENT WITH SMALL-MID SIZE LOT SIZES ALLOWS ROOM TO MOVE SO IF WRONG, STOPPED OUT BUT IF RIGHT CAN MOVE. WHEN TAKE TOO BIG POSITIONS, STOCKS CANNOT BREATHE SO EVEN IF RIGHT ENTRY, GET HIT!

Saturday, August 20, 2011

Daily target hit by +185%

BIDU short for reversion method, 1st attempt FAIL, 2nd attempt made up my earlier loss.

TNA went long on break of 39

LNKD Great entry on short and due to my earlier trades, psychologically found myself afraid of losing the days gains so took off entire position. LESSON: EACH TRADE IS A ITS OWN TRADE, NOT DICTATED BY PRIOR WIN OR LOSS

TNA went long on break of 39

LNKD Great entry on short and due to my earlier trades, psychologically found myself afraid of losing the days gains so took off entire position. LESSON: EACH TRADE IS A ITS OWN TRADE, NOT DICTATED BY PRIOR WIN OR LOSS

Thursday, August 18, 2011

Hit 210% daily goal. Lesson of day. ALLOW BREATH

CRM Short chase in and out

PCP Great bounce and actually tweeted this trade out real time

AAPL Long but bailed early for a loss

COST nice long. LESSON OF DAY, LET ALLOW FOR BREATH

PCP Great bounce and actually tweeted this trade out real time

AAPL Long but bailed early for a loss

COST nice long. LESSON OF DAY, LET ALLOW FOR BREATH

Wednesday, August 17, 2011

Hit 92% of daily target. SAME ISSUE OF TAKING WINNERS TOO QUICKLY

APKT great short on loss of lows, but didn't honor the violation of the 8MA exit rule leaving majority of potential gains on the table.

SINA 2 longs do make a right

POT break above yesterday high

WLT short and was too early, stopped for almost -1

APA great entry, crappy exit too quick

FCX 3 failed short attempts and threw in the towel like a chump before the market laughed and showed me how it can control one by inflicting ultimate frustration before yielding to ones theory.

SINA 2 longs do make a right

POT break above yesterday high

WLT short and was too early, stopped for almost -1

APA great entry, crappy exit too quick

FCX 3 failed short attempts and threw in the towel like a chump before the market laughed and showed me how it can control one by inflicting ultimate frustration before yielding to ones theory.

Tuesday, August 16, 2011

Long Ass Day.....worked too hard for +$1 today.

Left my notes at the office so don't have all the actual trades, times, and entries like i normally keep in my notebook, however after a careless mistake in attempt to SHORT FCX i hit buy instead of sell and took a fast loss. Shortly thereafter i tried SINA long 3 times and finally was able to catch support on my 4th attempt to make back my FCX losses and previous 3 SINA losses and after all was said and done, took home a whopping $1 so it's ordering off the dollar menu tonight...1 item.

Monday, August 15, 2011

Daily target hit by +175%. Still trading scared and taking profits too quick

IDCC Great short but was too scared, took small position and took profits quick.

BIDU Short and stopped for small loss, and never reentered. LESSON: IF STOPPED OUT AND ENTRY RESETS ITSELF, FOLLOW UP. A realized -.35 loss could have been +7 gain.

GTAT Great short entry but didn't let target get hit, pulled off prematurely

AMZN Great short on break of support. LESSON: STILL TAKING GAINS PREMATURELY. NEED TO FOCUS ON SCALING OUT AND NOT TAKING OFF FINAL POSITION UNTIL THE 8 MA IS VIOLATED!!

BIDU Short and stopped for small loss, and never reentered. LESSON: IF STOPPED OUT AND ENTRY RESETS ITSELF, FOLLOW UP. A realized -.35 loss could have been +7 gain.

GTAT Great short entry but didn't let target get hit, pulled off prematurely

AMZN Great short on break of support. LESSON: STILL TAKING GAINS PREMATURELY. NEED TO FOCUS ON SCALING OUT AND NOT TAKING OFF FINAL POSITION UNTIL THE 8 MA IS VIOLATED!!

Friday, August 12, 2011

Entries..check. Exits...errrr, not so much. Needs a little work. Daily target hit by +225%

TNA nice short and then long. LESSON: STILL TOO QUICK TO EXIT AS ENTRIES ARE SPOT ON

LULU Great breakout long

LULU Great breakout long

Thursday, August 11, 2011

Found my Mojo, Overshot daily target by over 450%

POT nice long on break above previous day high

GTAT Favorite pattern. Short after very extended move to previous day high

AMZN Call of the month, great support that it bounced, well executed plan.

GTAT Favorite pattern. Short after very extended move to previous day high

AMZN Call of the month, great support that it bounced, well executed plan.

Wednesday, August 10, 2011

Off my game. Closed the day red.

BIDU short and didn't take gains, then long for -1.

ATPG great short but messed up. LESSON: LET TRADE BREATH A LITTLE AND WATCH STOPS SO NOT SO TIGHT

ATPG great short but messed up. LESSON: LET TRADE BREATH A LITTLE AND WATCH STOPS SO NOT SO TIGHT

Subscribe to:

Posts (Atom)